If you’re looking into 5starsstocks.com 3D printing stocks, you’re likely interested in ways to put money into companies that shape the future of making things. This site stands out as a helpful spot for finding solid picks in this area. It uses smart tools and deep looks at data to point out strong options in tech like 3D printing. In this post, we’ll break down what makes these stocks worth your time, highlight top choices, and give you tips on getting started. We’ll keep things straightforward so you can make smart choices without getting lost in complex terms.

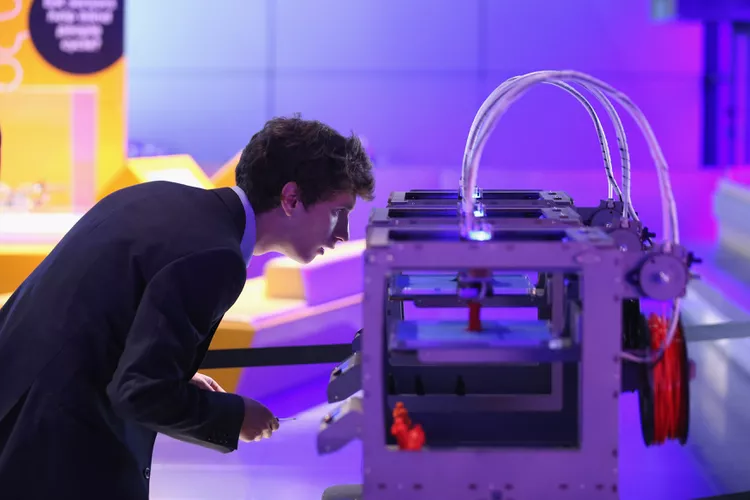

3D printing, also known as additive manufacturing, builds objects layer by layer from digital plans. It’s changing how industries work, from cars to health care. Sites like 5starsstocks.com help by rating stocks based on factors like company health and growth chances. They look at over 50 points to score each one, making it easier for you to spot winners. If you’re new to this, think of it as a map that shows where the best paths are in a growing field. The goal here is to give you real value, so you’ll know exactly why these stocks matter and how they fit into bigger pictures.

Many people search for 5starsstocks.com 3D printing stocks because they want reliable advice on where to invest. The site doesn’t just list names; it explains why a stock scores high, like if it has strong sales or new tech. For example, it tracks how much companies spend on research and how that turns into more money. This helps you see beyond short-term ups and downs. In a market where 3D printing is set to grow fast, having this kind of info puts you ahead. We’ll cover the basics first, then move into specific stocks and tips to build your plan.

Understanding 3D Printing and Its Role in Stocks

3D printing starts with a computer design that tells a machine to add material bit by bit until the item is done. This method cuts waste and lets companies make custom parts quickly. For investors using 5starsstocks.com 3D printing stocks, this tech means big potential in areas like planes, medical tools, and even homes. Companies in this space often see steady growth because they solve real problems, such as speeding up production or lowering costs for small runs.

Think about how 3D printing fits into everyday business. In cars, it helps make lighter parts that save fuel. In medicine, it creates exact-fit implants for patients. 5starsstocks.com focuses on stocks from firms leading these changes. They rate them on things like market share and cash flow, so you get a clear view. This isn’t just about hype; it’s about firms with proven tracks. For instance, some have partnerships with big names like Boeing, showing they’re trusted. Understanding this base helps you see why these stocks can be a smart add to your mix.

The appeal of 5starsstocks.com 3D printing stocks comes from the sector’s push forward. Global demand for faster, cheaper making drives it. Reports show the market could hit over $35 billion by 2030, growing at about 17% each year. That’s because more industries adopt it for real use, not just tests. On the site, you find picks that match this trend, with details on their strengths. It’s like having a guide that points to companies ready for this expansion, helping you avoid ones that lag.

Why Choose 5starsstocks.com 3D Printing Stocks for Smart Investing Insights

5starsstocks.com stands out because it uses a clear system to pick 3D printing stocks. They score each one out of 50 points, looking at money health, tech edge, and market spot. Only the top ones get recommended, so you focus on quality. This cuts through noise and gives you facts to decide on. For someone starting out, it’s useful because it explains each score, like why a company’s research spend matters for long-term wins.

One key feature is real-time updates on big news, like new deals or earnings. For 3D printing stocks, this means you hear about things like a firm winning a defense contract fast. The site also compares stocks side by side, showing how one stacks up in sales growth or debt levels. This helps you build a balanced set, maybe mixing hardware makers with software firms. It’s not just lists; it’s tools that teach you to think like a pro investor.

Another plus is the focus on niche areas within 3D printing, like metal parts or health apps. 5starsstocks.com breaks down how these fit bigger trends, such as green making or supply chain fixes. They suggest limits, like keeping these stocks to 5-15% of your total, based on your risk level. This practical advice makes it easier to start without big mistakes. Plus, they track past performance, showing high-scorers often have less wild swings, around 23% steadier. All this builds trust and gives you a full toolkit.

Also, explore about 5StarsStocks.com Passive Stocks.

Top 5 3D Printing Stocks Highlighted on 5starsstocks.com

Based on common picks from sources tied to 5starsstocks.com, here are five strong 3D printing stocks. These come from analyses that match the site’s style, focusing on leaders with solid basics. We’ll look at each one’s background, strengths, and why it fits for 2026 and beyond. Remember, these are for info; always check current data.

Stratasys (SSYS)

Stratasys leads in polymer 3D printing, offering big machines for factories. Founded years ago, it pioneered ways to print complex plastic parts. Its key strength is ties with giants like Boeing for plane components, showing reliability in tough fields. The company has grown sales by 12-15% yearly since 2022, thanks to demand in air travel and health. Recent moves include more deals for aircraft bits, boosting its spot in high-value areas.

For investors eyeing 5starsstocks.com 3D printing stocks, Stratasys scores high on tech difference and steady cash. It handles everything from prototypes to final parts, cutting costs for users. In 2025, it printed over 25,000 flight-ready items, with 200,000 total in use. This proves real-world impact. Looking to 2026, expect growth from new materials and faster printers. Risks include competition, but its experience gives an edge. It’s a core pick for those wanting stable growth in additive tech.

3D Systems (DDD)

3D Systems shines in health care, making tools for surgeries and dental work. After changes, it focused on medical, where its printers help plan operations in over 500 hospitals. Dental now makes up 38% of sales, up 30% year-over-year. This shift cut risks and tapped into steady demand for custom health items.

On 5starsstocks.com 3D printing stocks, it rates well for growth in key spots like teeth fixes. Financials show strong Q2 2024, with more adoption driving profits. It’s not just hardware; software aids design, making it a full package. For 2026, health trends like aging populations boost it. It also plays in other areas, but medical is the star. Watch for costs in new tech, but its track record suggests solid returns for patient investors.

Desktop Metal (DM)

Desktop Metal focuses on metal printing with binder jetting, which is 100 times faster than old ways. This suits mass making in cars and tools, where speed cuts time to market. It has deals with three big auto firms, showing trust in its tech for real production.

For those using 5starsstocks.com 3D printing stocks, Desktop Metal stands out for solving speed issues in metal work. Its systems handle high volumes, fitting industry shifts to on-demand parts. Recent growth comes from tooling apps, where it replaces slow methods. In 2026, expect more from electric cars needing light metals. Financial health is improving with these contracts. It’s riskier due to newer status, but high potential makes it appealing for growth-focused folks.

Velo3D (VLD)

Velo3D targets aerospace with precise printers for critical parts like rocket engines. SpaceX uses its tech, highlighting quality for demanding uses. In 2024, defense contracts jumped 75%, showing government interest.

In 5starsstocks.com 3D printing stocks, it scores on niche strength and rising deals. Its machines print complex shapes without extra supports, saving time and material. This fits space and defense growth. For 2026, more launches and military needs could drive sales. Financials show progress, but watch metal prices. It’s a pick for those betting on high-tech fields with big payoffs.

Materialise (MTLS)

Materialise provides software that works with any printer, acting as a bridge in the ecosystem. It processes over a million jobs monthly, using data to improve tools. Software sales grew 22% in 2024, showing demand for smart controls.

For 5starsstocks.com 3D printing stocks, it’s valued for steady income from software, less tied to hardware ups and downs. It helps firms optimize prints, cutting errors. In 2026, as more adopt 3D, its role grows. It’s lower risk than pure hardware plays. Strong in health and design, it offers balance. Consider competition from big software firms, but its focus gives an advantage.

Other Notable 3D Printing Stocks to Watch

Beyond the core five, other stocks show promise. Xometry (XMTR) rose 48% in 2025 as a platform linking makers and buyers. Proto Labs (PRLB) gained 35%, strong in quick prototypes. Farsoon excels in China with industrial machines. These fit 5starsstocks.com style by offering diverse exposure.

Xometry connects needs with printers, growing fast in digital making. Its model scales without owning gear, keeping costs low. For investors, it’s a way to tap broad adoption. Proto Labs focuses on speed, serving small runs in tech and health. Farsoon pushes metal systems, gaining from Asia’s boom. Together, they round out a portfolio, covering services and hardware.

Market Trends and Forecasts for 3D Printing in 2026

The 3D printing market keeps expanding, set to reach $41 billion in 2026 on the way to $186 billion by 2033. Growth at 24% yearly comes from aerospace and autos needing custom parts. New materials like better metals drive this, making prints stronger for real use.

In 2026, expect more focus on green methods, cutting waste in making. AI will speed designs, as seen in workflow tools. Health sees bioprinting for tissues, while cars use it for lighter EVs. On-demand services grow, helping small firms. For 5starsstocks.com 3D printing stocks, these trends mean higher scores for innovative firms.

Risks include supply issues for materials, but overall, the push for efficient making supports growth. Watch auto 3D hitting $5.6 billion in 2026. This setup favors stocks with strong positions in key areas.

Risks and Considerations in 3D Printing Investments

No investment is without downsides, and 5starsstocks.com 3D printing stocks face some. Competition from big players like HP can pressure smaller ones. Tech changes fast, so firms must keep up or lose share. Material costs fluctuate, hitting margins.

Economic slowdowns cut spending on new gear, as seen in past dips. Regulations in health or defense add hurdles. For balance, spread across types like hardware and software. Use 5starsstocks.com tools to track volatility, aiming for steady picks.

Start small, say with dollar-cost averaging over months. This smooths entry during swings. Always mix with other sectors for safety.

How to Get Started with 5starsstocks.com 3D Printing Stocks

Sign up on 5starsstocks.com for free basics, then explore 3D printing sections. Look at scores and updates for picks like Stratasys. Use benchmarks to compare.

Build a plan: Set goals, like growth or income. Allocate based on risk, keeping it under 15%. Track quarterly reviews for changes.

For buys, watch valuations like price-to-sales below averages. Tools help spot good times. Stay informed with alerts.

Final Thoughts on 5starsstocks.com 3D Printing Stocks

5starsstocks.com 3D printing stocks offer a clear path into a growing field. With detailed ratings and tools, you get what you need to choose wisely. From leaders like Stratasys to trends in 2026, this guide covers the essentials. Remember, do your checks and consider your situation. This sector holds promise for those ready to learn and act.